The American new-car market is hitting an unfamiliar speed bump. As the Federal Reserve continues to raise interest rates, the cost of borrowing for a new vehicle has soared, leaving many would-be buyers reconsidering whether now is the time to trade up. Showroom traffic is barely growing, and auto sales are trending downward as higher monthly payments put even mainstream models out of financial reach for a growing number of households.

In response, automakers and dealerships are shifting gears. Rather than competing on ultra-low financing deals (which have all but vanished for loans), they’re reviving and aggressively marketing 0% lease offers. Leasing, once viewed as a niche strategy, has become the practical option for buyers determined to get behind the wheel without breaking the bank. This article unpacks why leases are surging, how the economics work in a high-rate environment, and what strategies smart car shoppers are now using to secure the best possible deals.

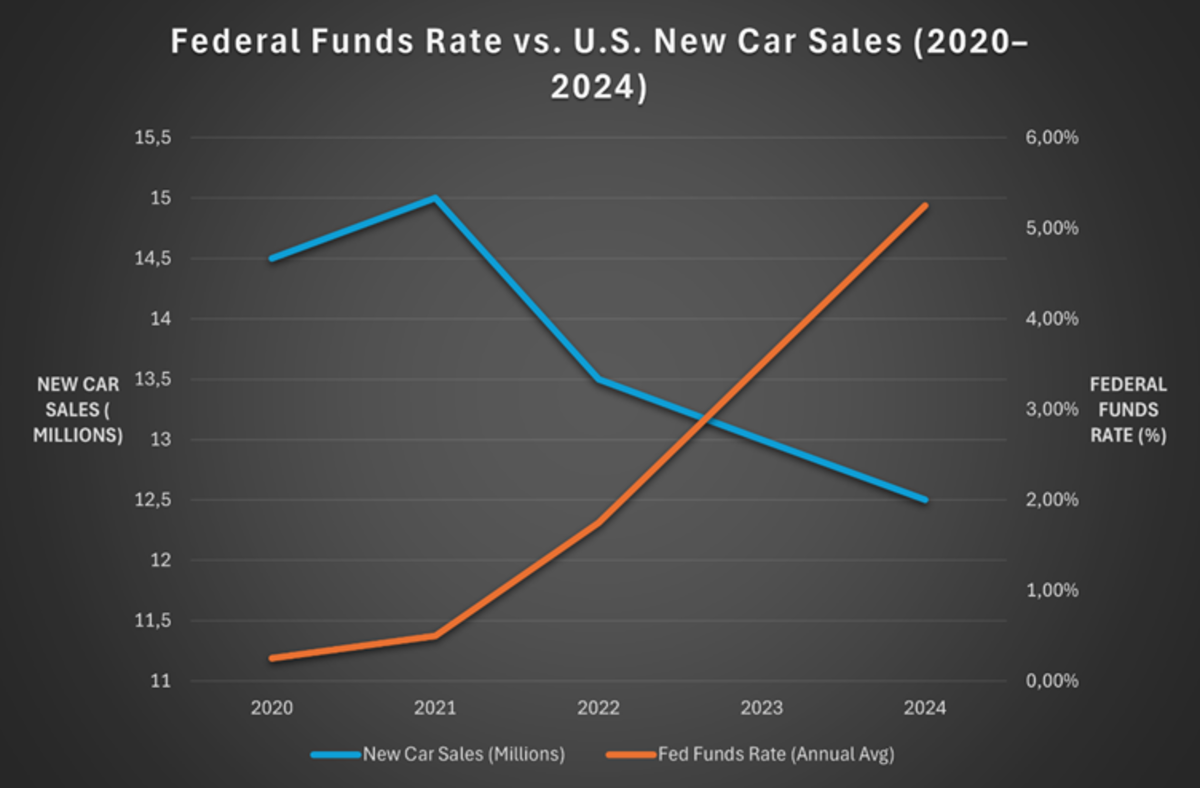

Now, let’s take a look at some numbers for those so inclined.

Figure 1. This overlay plots the Fed’s annual average funds rate (right axis) against U.S. new-car sales in millions (left axis) from 2020 through 2024. Notice how almost perfectly each uptick in the cost of money coincides with downticks for new car sales.

How Rate Hikes Hit Buyer Demand

Each 0.25-point Fed hike typically raises average auto-loan APRs by 0.06–0.08 points — less than the previously estimated 0.10-point pass-through. When rates climbed from 0–0.25% in 2020 to 5.25–5.50% by mid-2023, consumer APRs rose roughly 1.2 points overall. On a $35,000, 60-month loan, each 1% APR increase adds $70–$75 to the monthly payment — enough to force many buyers to rethink what (or whether) to buy.

Financing Pressure and Consumer Choices

Facing these steeper costs, consumers are changing how they finance new cars. Higher APRs nudged buyers toward shorter terms. By early 2024, 38% of new auto loans were 48 months or shorter—up from 34% in 2021—as buyers looked to cut interest costs despite steeper monthly bills. That trim in term cuts total interest paid but raises monthly bills, squeezing cash-strapped shoppers. Meanwhile, overall lease share climbed to about 27% of new-vehicle contracts — up 2 points since 2021 — as lessees dodge long-term rate pain.

Down Payments, Trade-Ins and Real-World Impact

To soften APR hikes, buyers ramped up down payments. The average down payment edged from about 10.5% of MSRP in 2021 to nearly 12% in 2024 . Higher upfront cash trims financed principal but locks first-timers out of the market. Automotive retail foot traffic grew just 1.3% in 2024, a sharp drop from the post-pandemic rebound. Showroom visits had jumped as much as 17% in 2022 amid pent-up demand, but that surge has clearly faded. According to Colliers and Placer.ai, auto dealership traffic now lags broader retail trends, with higher borrowing costs and tighter credit dampening consumer urgency. The soft gain signals a shift toward more cautious shopper behavior amid rising vehicle affordability pressures.

The Smart Moves: Cash Rebates & 0% EV Leases

Rising rates reroute buyer behavior. Dealerships swapped low-APR incentives for cash rebates and expanded 0% APR leases on EVs to sustain sales. Savvy shoppers can now lock in short-term loans or lease promos to dodge higher borrowing costs. As the federal funds rate holds near 5.25%, expect pent-up demand once borrowing eases — but for now, 0% deals remain your best defense against rising APRs.