Automaker Hopes Investment In LFP Cells Will Yield Cost Savings Down The Line

General Motors announced on Monday that it will upgrade its Spring Hill, Tennessee, battery plant to manufacture lower-cost lithium-iron-phosphate (LFP) cells. Conversion of cell production lines for LFP is scheduled to begin later this year, with commercial production expected to start by late 2027, GM said in a press release.

The Spring Hill plant is part of the Ultium Cells LLC joint venture between GM and battery supplier LG Energy Solution. A sibling plant in Warren, Ohio, will continue to produce cells with nickel manganese cobalt (NMC) chemistry used in current GM EVs, but the automaker expects “significant battery pack cost savings” compared to today’s NMC packs.

Cheaper Chemistry Could Lead To Cheaper EVs

General Motors

LFP is generally recognized as a lower-cost alternative to NMC chemistry in part because it uses more common raw materials. LFP cells are also generally more durable, holding up better to more aggressive charge and discharge cycles, but the tradeoff is lower energy density. That means less range for a given battery-pack volume compared to the NMC cells currently used by GM—and most other automakers selling EVs in the United States.

Related: China’s $10 EV Battery Could Upend the US Auto Market

However, energy density hasn’t held back LFP in China, where it’s long been the dominant chemistry not just for electric passenger cars, but for commercial trucks and buses as well. Tesla has also embraced LFP for certain U.S.-market models, and Ford plans to manufacture LFP cells at its BlueOval Battery Park complex in Michigan.

GM’s announcement didn’t detail which vehicles would receive LFP cells from the Spring Hill plant, which is located adjacent to the former Saturn assembly complex that currently builds the Cadillac Lyriq and Vistiq, as well as the Acura ZDX. But less-expensive cells could help the next-generation Chevrolet Bolt EV (and potentially other models) achieve a meaningfully lower price than the Chevy Equinox EV, currently GM’s cheapest electric model.

Hardware Flexibility Makes It Possible

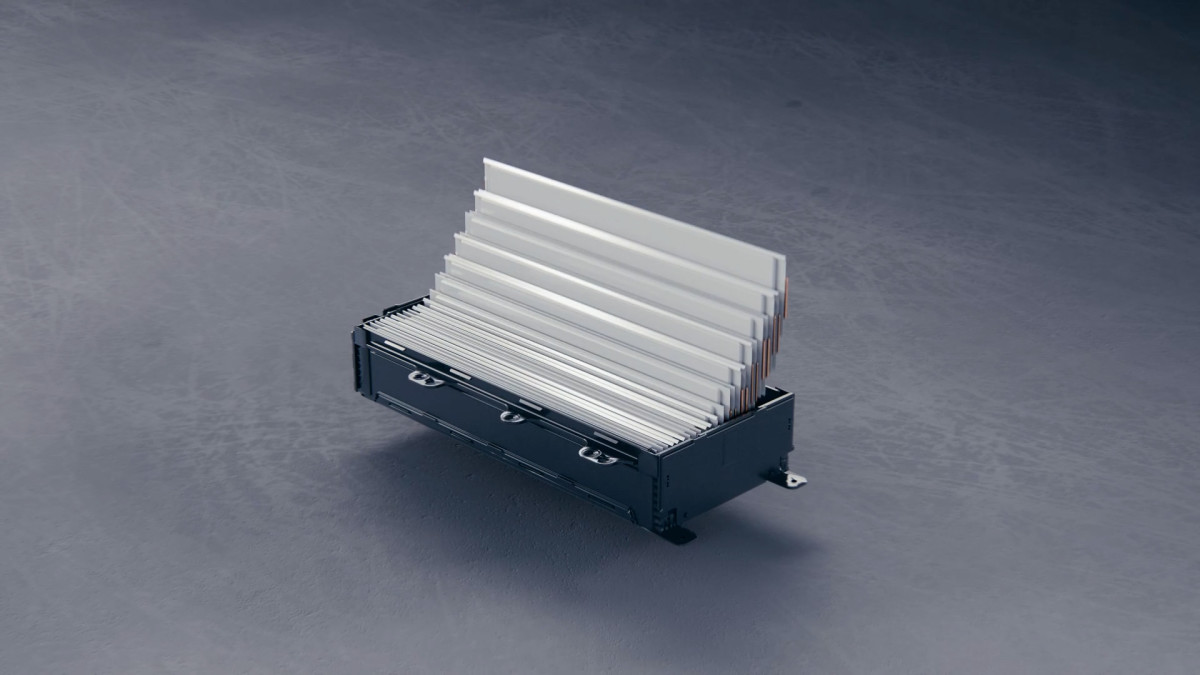

GM has long touted the flexibility of its EV component set, formerly known as Ultium (that brand name is now used only for the cell-manufacturing joint venture), encompassing standardized modules, motors, and a wireless battery management system. Now it’s proving the ability to juggle multiple chemistries is more than just a boast.

In addition to continued production of NMC cells in Ohio and the start of production of LFP cells in Tennessee, GM has said it aims to be the first company to commercialize lithium manganese rich (LMR) battery tech. LMR has been studied since the 1990s, but durability issues have held back commercialization. GM claims to be tackling them, with the goal of providing at least 400 miles of range in electric trucks at a lower cost than NMC cells like the ones in the current Chevy Silverado EV.

Chevrolet