Another quarter of red for Nissan

On June 30, Japanese automaker Nissan reported a big loss of 115.7 billion yen ($782 million) during the first quarter of its fiscal year from April to June. This loss comes as the company is in the middle of its Re:Nissan restructuring efforts and attempting to navigate a hefty 25% tariff on imported Japanese cars imposed by U.S. President Donald Trump back in April.

This quarter of red marks the fourth straight quarter of losses for the automaker; a far cry from the profit of 28.5 billion yen they reported during the same period last year. On top of that, sales for the quarter hit 2.7 trillion yen, down 9.7% from the previous year, showing just how tough things are for the company right now. Furthermore, it predicts an operating loss of 100 billion yen during its next fiscal quarter after posting a 79 billion yen operating loss during the previous fiscal quarter.

Getty Images

Trump’s 15% tariffs on Japanese imports are still “challenging,” Nissan CEO says

The announcement of Nissan’s quarterly financial numbers comes very shortly following the recently announced U.S.-Japan trade agreement, which has reduced automotive tariffs from 25% to 15%. As a result, the automaker reduced the estimated hit to its profit from up to 450 billion yen to 300 billion yen.

In a news conference at the automaker’s headquarters in Yokohama on the afternoon of July 30, Tokyo time, Nissan CEO Ivan Espinosa warned that it isn’t exactly smooth sailing just yet. Global sales during the quarter reached just 707,000 vehicles, a 10.1% dip compared to the year before. Additionally, sales were down 2.4% in North America and 11.1% in Japan.

“We welcomed the improvement, but 15% is still a challenging number,” Espinosa said. “And this is why we need to continue our efforts to improve costs.”

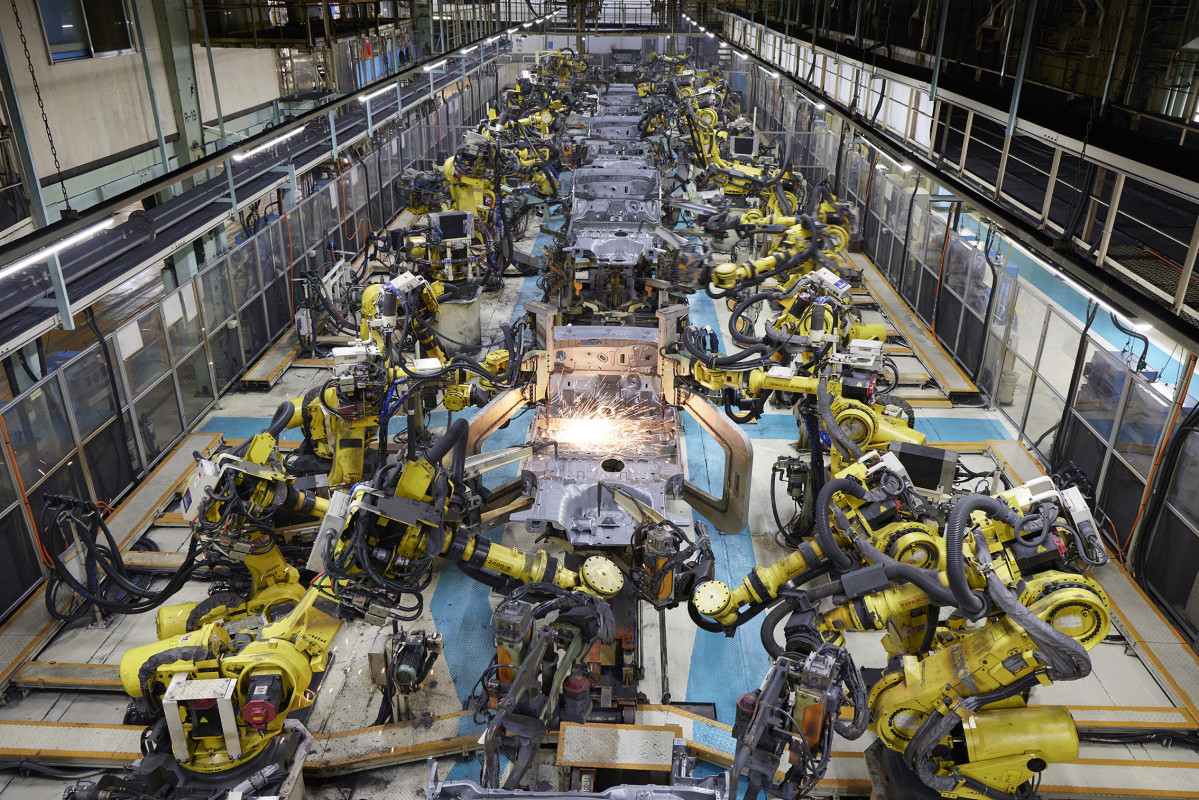

In addition, Espinosa emphasized that it is keeping an eye on trade and tariff developments between the U.S. and its neighbor south of the border, as he notes that the automaker has “a significant volume coming from Mexico.” Though it boasts a major manufacturing presence with factories in Smyrna and Decherd, Tennessee, and Canton, Mississippi, 45% of the cars sold in the United States are imported from Mexico and Japan.

Nissan

Despite the numbers, its restructuring plan is going well. Nissan CFO says

During the news conference, Nissan’s Chief Financial Officer Jeremie Papin recognized and acknowledged that “the Q1 results were weak,” but added that the company is doing well in executing its Re:Nissan restructuring and corporate austerity program. Per the Re:Nissan restructuring plan, the automaker plans to shed 20,000 jobs and close up to seven factories by March 2028. In addition, the company aims to save 500 billion yen by the end of the 2026-2027 fiscal year, which ends in March 2027.

“We are advancing steadily with Re:Nissan, and that progress is encouraging,” Papin said. “At the same time, the magnitude of our challenge remains significant, as reflected in our Q1 results, which reinforces the urgency of continued, disciplined execution.”

Getty

One of those actions took place the same day it announced its results. Following similar action affecting the flagship historical Oppama plant earlier this month, Nissan announced on the morning of June 30, Tokyo time, that it will sunset production at its historical CIVAC plant in Mexico by March 2026 as part of the Re:Nissan restructuring plan; a decision that was a gutpunch to Espinosa.

“When we made the analysis, we found that the most efficient way was to consolidate everything into Aguascalientes … painful decision … not only because I’m from the region but because it’s affecting the lives and sustainment of families,” Espinosa said.

Final thoughts

Nissan’s situation is unique, and as I mentioned previously, it must overcome more than low sales and a bloated production capacity to save itself; it still has to play ball in its largest market, the United States. However, over the past few weeks and months, the Trump administration and its tariff-heavy trade policy have dotted the world map with different tariff rates.

Per Axios, starting August 1, cars imported from Japan or Europe will face a 15% tariff in lieu of a 25% tax hike the U.S. imposed on all imported vehicles and car parts earlier this year. At the same time, cars built in Canada and Mexico face a 25% tax, and will face even higher tariffs on Aug. 1: 35% for cars from Canada and 30% for Mexico.

To make matters more complicated, non-USMCA-compliant car parts face a 25% tariff, which can make cars produced by the Detroit Big Three and manufacturers like Nissan, Honda, Subaru, and other foreign manufacturers that have U.S. plants more expensive to build. Given Nissan’s heavy multi-decade investment in Mexico, any news of a trade deal between the Trump administration and our neighbors south of the border could be a consequential one for Nissan. We will have to wait and see.