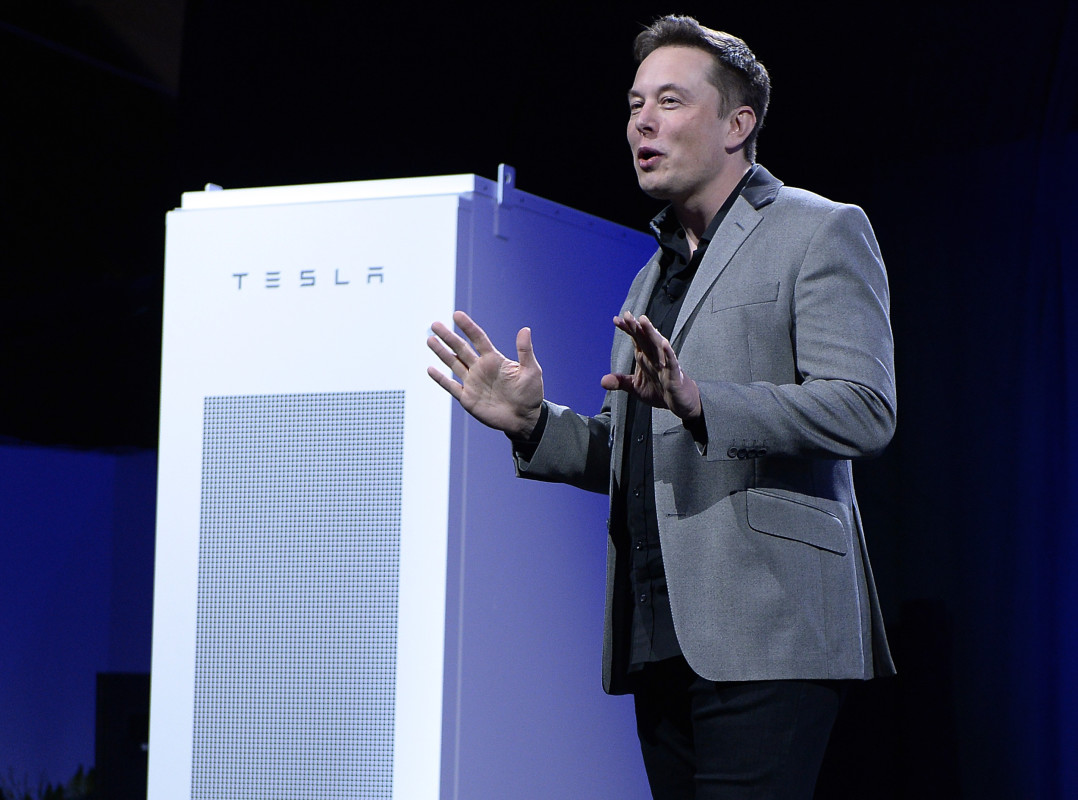

Elon Musk has confirmed that Tesla has inked a colossal $16.5 billion deal with Samsung Electronics to produce its next-generation AI chips. The long-term agreement, one of Samsung Foundry’s largest ever, will see production begin at its cutting-edge facility in Taylor, Texas, starting in 2026. While Musk called the agreement’s size a “minimum commitment,” the real number could rise significantly — a strategic flex in a year when Tesla needs all the leverage it can get.

Kevork Djansezian via Getty Images

Betting Big On AI While Sales Lag

This deal is central to Tesla’s push to develop proprietary chips that power its autonomous systems, humanoid robots, and Dojo AI training hardware — but it also comes at a turbulent time. The company’s recent Q2 financials revealed yet another decline in profits, with Elon Musk warning investors of “another rough quarter or two” ahead. While Tesla’s Model 3 and Model Y continue to sell, they’re no longer the only game in town — and competition is fast catching up.

Enter China’s Xiaomi. The tech giant just launched its YU7 electric SUV, with 200,000 orders placed in under three minutes. And in a move Musk surely won’t appreciate, Xiaomi confirmed plans to take its cars global by 2027 — directly challenging Tesla’s Model Y dominance in both pricing and availability.

Caixin Global

Made In Texas — But At What Cost?

The Tesla-Samsung chips, known internally as “A16,” will be built using Samsung’s 4-nanometer process and are intended to reduce reliance on Nvidia hardware. While the partnership could prove revolutionary, some analysts are cautious. Samsung’s foundry arm has struggled with yield rates, and insiders suggest Tesla may have received favorable terms to sign on. Even so, Musk has said he’ll personally oversee performance and production at the Taylor site — which happens to be just down the road from his home.

Legal And Performance Headaches Mount

Tesla’s drive to dominate AI and automation is now shadowed by growing scrutiny of its hardware and marketing. Just days before the Samsung announcement, a Norwegian court ordered Tesla to buy back a Model S Plaid after the car’s brakes failed catastrophically on track. The ruling concluded Tesla’s performance claims were misleading, forcing the company to refund the full $150,000 purchase price and cover legal costs.

It’s a troubling footnote for a company that’s built its brand on technological superiority — and it highlights just how high the stakes are for Tesla’s next-generation chip strategy. If its AI-powered future is to materialize, Tesla will need more than bold promises. It will need chips that work — and brakes that stop.