For the first time in over a decade, Tesla’s annual electric vehicle (EV) sales have dropped. The automaker sold 1.79 million vehicles in 2024, a slight decline from 2023 and below analysts’ expectations. Despite a record-breaking fourth quarter with 495,570 deliveries, Tesla fell short of achieving its annual growth target, marking a 1.1% decline year-over-year.

The grim milestone reflects Tesla’s growing challenges. An industry-wide EV sales slowdown, lukewarm consumer demand, and shipping disruptions all weighed heavily on performance. In April, the company also faced an arson attack at its Berlin factory and announced significant workforce cuts, including sales staff.

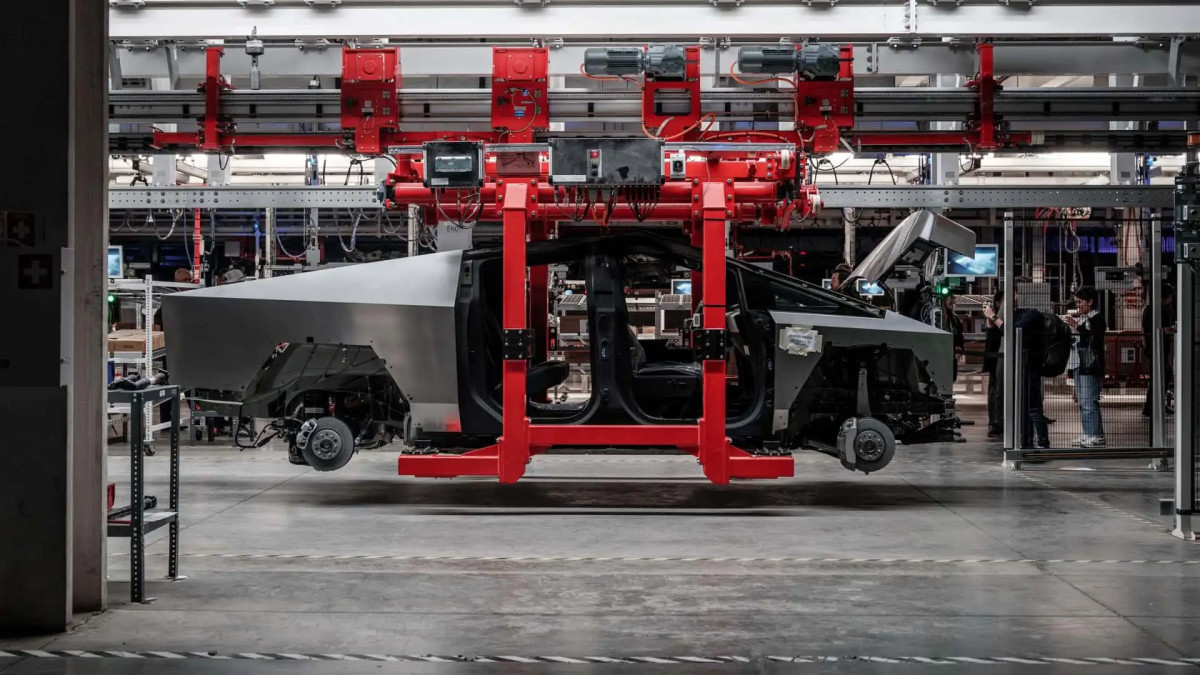

Tesla

Related: UK’s absurd £15,000 fine per car EV policy hurts automakers and buyers

BYD closes the gap

Tesla’s main rival, the Chinese automaker BYD, surged ahead in 2024 with 4.25 million passenger car sales, including 1.76 million fully electric vehicles. BYD’s annual EV sales rose by 41% compared to 2023, fueled by robust government subsidies and additional buyer incentives.

BYD

December was a standout month for BYD, with over 207,000 EVs sold, helping the company set a new monthly sales record. While Tesla narrowly retained its title as the global EV leader, the gap between the two companies has shrunk to just 30,000 vehicles. BYD’s aggressive growth strategy and expanding product lineup are clear indicators of its ambitions to dethrone Tesla in the near future.

Related: Porsche walks back EVs – people still want gas cars

Navigating choppy waters

Tesla’s challenges extend beyond competition. The incoming U.S. administration under President-elect Donald Trump has expressed skepticism toward EV incentives, which could jeopardize federal tax credits critical for boosting sales. However, Tesla may benefit from Trump’s anticipated loosening of self-driving vehicle regulations, which would align with the company’s autonomous vehicle goals.

Tesla

Tesla CEO Elon Musk has expressed optimism for 2025, forecasting 20% to 30% growth, bolstered by the introduction of a new, more affordable EV model expected in the first half of the year. Of course, if past Tesla launch timelines are anything to go by, we’re not holding our breath, and analysts appear to feel the same. Despite these projections, analysts remain cautious, citing uncertainties around demand and the competitive landscape.

Related: 2025 Toyota 4Runner fuel economy manages to be better—and also worse

A bigger fish in the ocean

Tesla’s dominance is no longer guaranteed. BYD’s rapid ascent is a wake-up call not just for Tesla but for traditional automakers struggling to transition to EVs. Companies like Volkswagen and Stellantis are grappling with declining sales and sluggish electrification efforts, further highlighting BYD’s momentum.

Final thoughts

The EV market’s future will be defined by fierce competition, innovation, and shifting consumer preferences. Tesla’s ability to maintain its leadership will depend on its response to market pressures and its capacity to innovate with new products. At the same time, BYD’s continued growth is reshaping the industry, setting the stage for an intense battle for EV dominance in 2025 and beyond.

Related: Chinese automakers build their way around tariffs