Volkswagen’s affordable EV push is leveraging new battery tech

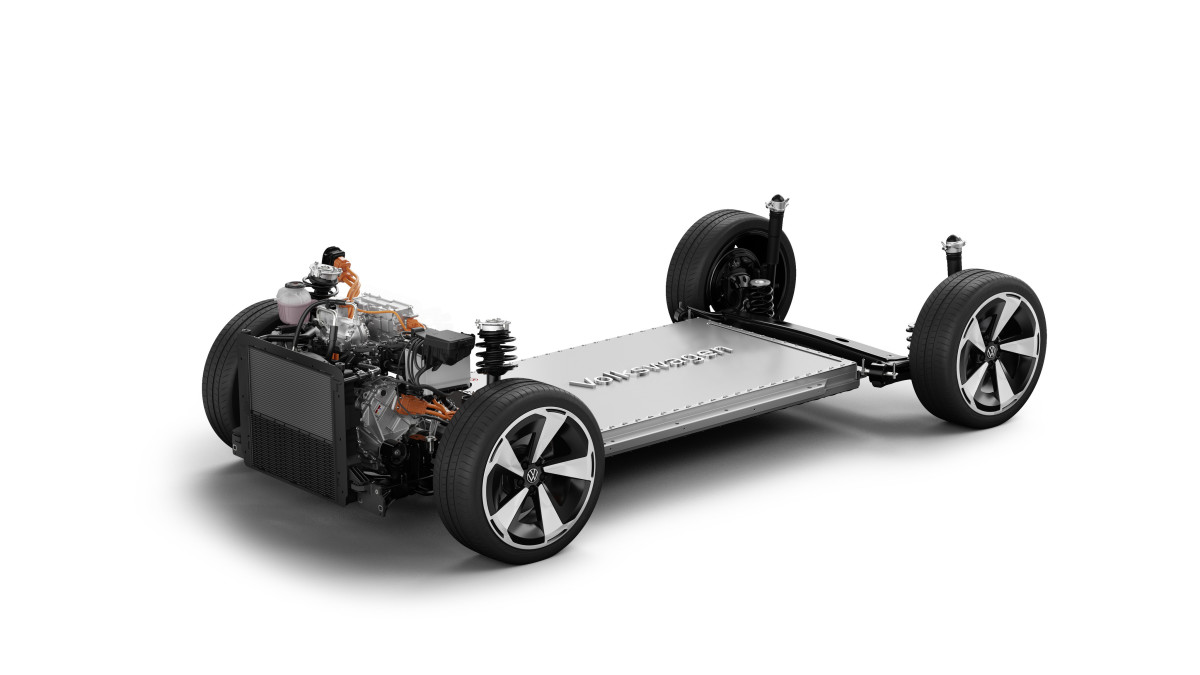

Volkswagen (VW) has scheduled a substantial refresh of its electric lineup starting in 2026 with the release of the ID.2 supermini, the automaker’s first-ever model to use lithium-iron-phosphate (LFP) battery tech that’s less expensive than its current nickel-manganese-cobalt (NMC) packs, as first reported by Autocar UK. The VW Group’s upcoming core EVs will segue from today’s MEB platform into a new LFP battery platform named MEB Plus.

LFP battery cells have slightly less energy density than NMC packs, but their production cost savings outweigh this energy discrepancy. The savings primarily stem from LFP batteries being less reliant on expensive materials like cobalt than NMC packs. New LFP cells also have higher thermal stability and a longer lifespan. After the ID.2’s release, MEB Plus will make its way into VW models like the ID.3 hatchback, the U.S. market’s ID.4 SUV, and the ID.7 sedan. Tesla was the first automaker to bring LFP batteries to the mass market with its Model 3 in China, followed by Ford’s Mustang Mach-E.

Volkswagen

News of the MEB Plus platform is significant given VW’s earlier struggles in the EV segment. These roadblocks included the ID.3 and ID.4 launches experiencing software glitches, interior material quality complaints from users, and a perception that the vehicles didn’t match or surpass the value of competitors like Tesla. VW’s new Salzgitter, Germany, factory will manufacture the upcoming LFP batteries alongside the current NMC packs until they’re phased out. The automaker’s CEO, Thomas Schäfer, told Autocar UK: “You can see this move towards LFP across the board, except for performance applications on the upper end. In the volume game, LFP is the technology.”

Final thoughts

MEB Plus will revitalize VW’s EV lineup until the company launches its delayed SSP platform, a multi-billion euro extension of the current MEB modular system, according to Battery Industry. VW’s use of MEB Plus also marks the brand’s first substantial shift into a new platform that’s cheaper to make, enhancing its mass market prospects. While the ID.2 is the automaker’s first direct entry into the affordable EV market, it likely won’t make it to the U.S., where VW and other manufacturers face export challenges with tariffs and an Inflation Reduction Act (IRA) that’s on the verge of a substantial reorganization. Changes to the IRA could also slow the growth of U.S. battery production facilities, even if VW expands its U.S. manufacturing presence.

Volkswagen

Still, current and prospective U.S. EV drivers can look forward to cost reductions and possible range increases in models like the VW ID.4 SUV, along with GM’s commercialization of LMR (lithium manganese-rich) prismatic battery cells that bring extended range electric trucks through more accessible pricing. Like VW’s LFP battery tech, GM’s LMR cells are less reliant on cobalt, which has introduced ethical dilemmas in addition to higher costs. Cobalt mining has exposed local communities, primarily the Democratic Republic of the Congo, to toxic metals while contributing to environmental degradation. The Democratic Republic of the Congo produces about 70% of the world’s cobalt supply.